Investing in silver bullion can be a rewarding venture, but it requires some savvy and knowledge. Whether you’re a seasoned investor or a newcomer, understanding the ins and outs of silver purchases can make all the difference.

This article presents five practical tips to assist in your silver bullion buying journey.

1. Research the Market

Before making any purchases, it’s essential to familiarize yourself with the silver market. Start by exploring current trends and historical price fluctuations. Check online resources, market reports, and expert analyses to build a comprehensive understanding of how silver prices move.

Getting a grasp of market dynamics can help you identify the right time to buy. Prices can vary widely based on numerous factors, including geopolitical events, currency fluctuations, and economic indicators. Use this knowledge to position yourself as a mindful investor, ready to make informed decisions.

Don’t overlook the importance of keeping up with news related to precious metals. Staying informed about global economic developments and advancements in mining technology can influence silver supply and demand. If you’re ready to take the next step, now might be a great time to shop silver bullion at great prices through reputable dealers.

Lastly, consider using tools like price charts to visualize trends over time. These charts can provide clarity and aid in recognizing patterns that might indicate favorable buying opportunities.

2. Choose the Right Type of Silver Bullion

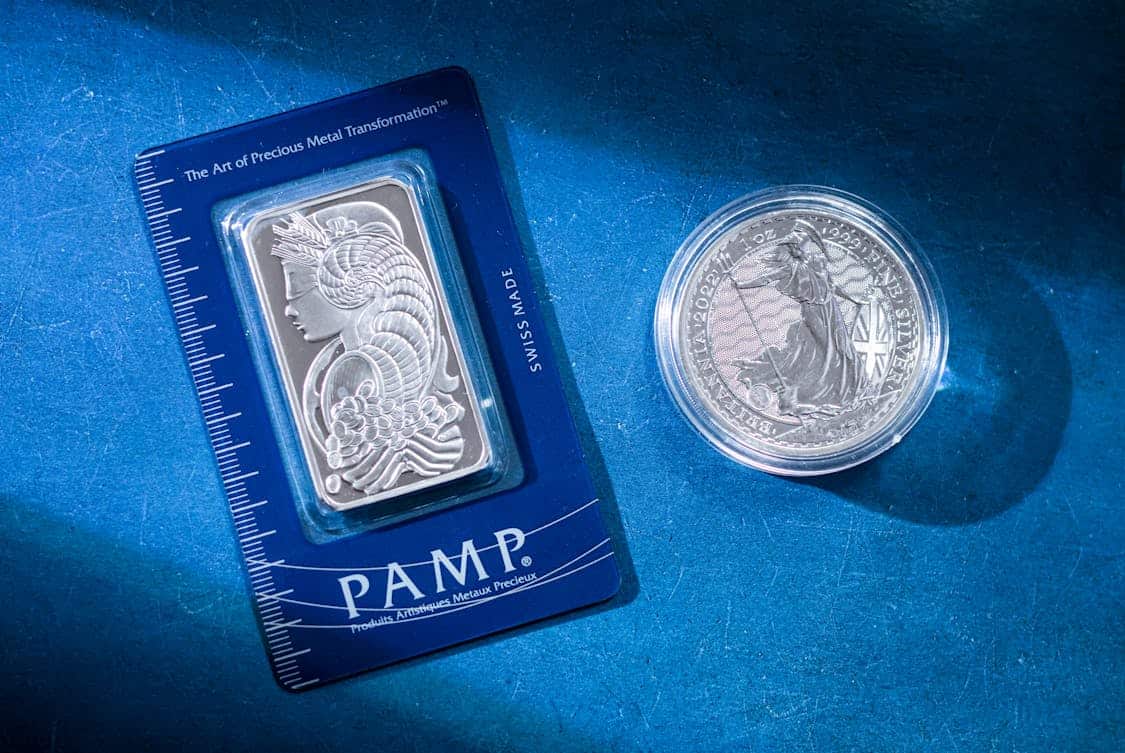

Silver bullion comes in various forms, including bars, coins, and rounds. Each type has its unique characteristics, benefits, and drawbacks. For instance, coins often have higher premiums due to their government backing and collector appeal. On the other hand, silver bars typically have lower premiums per ounce, making them a cost-effective option for bulk purchases.

Think about your investment goals when selecting the type of bullion. If you’re looking for long-term storage and lower costs, bars might be your best bet. Meanwhile, coins can offer liquidity when it’s time to sell, as they are widely recognized and accepted.

You should also be aware of the purity level of the silver you’re buying. Most investment-grade silver should have a purity of at least 0.999. This means that the product is composed of 99.9% pure silver, ensuring you’re getting quality bullion.

Lastly, consider the potential for future appreciation. Certain coins, such as those from reputable mints, may increase significantly in value over time. Research the history of the coins you’re considering to understand their potential market performance.

3. Buy from Reputable Dealers

Selecting a trustworthy dealer is paramount in your silver buying experience. A reliable dealer should have a solid reputation, transparent pricing, and a clear return policy. Start by reading reviews and testimonials from previous buyers to gauge the dealer’s reliability.

Comparing prices among various dealers can also help ensure you’re getting a fair deal. Be cautious of prices that seem too good to be true, as these might be red flags for scams or inferior products. A competitive price is essential, but quality should never be compromised.

It’s also wise to inquire about the dealer’s affiliations and memberships in professional organizations. Membership in groups like the Professional Numismatists Guild (PNG) or the American Numismatic Association (ANA) can indicate a commitment to ethical practices and standards.

As an added layer of security, consider purchasing from local shops or trusted online platforms. This can give you peace of mind knowing you’re dealing directly with a reputable source. Always ask about the dealer’s policies regarding authenticity guarantees, as this can protect your investment.

4. Consider Storage Options

After acquiring silver bullion, deciding on storage is a vital consideration. Proper storage can protect your investment from theft, damage, or deterioration. There are several options available, each with its advantages and disadvantages.

Home storage is the most common choice, allowing you to keep your bullion within arm’s reach. While this offers convenience, there are risks involved, such as theft or loss. If you choose this route, invest in a high-quality safe that is bolted to the floor and consider diversifying where you store your bullion to minimize risk.

Alternatively, using a safe deposit box at a bank provides a secure environment for your bullion. This option can protect your investment but often comes with annual fees. Be sure to check the bank’s policies on the specific items permitted in the safe deposit box, as some may have restrictions.

Another popular method is utilizing professional vault storage services. These facilities specialize in securing precious metals and often provide insurance coverage. While this option typically incurs additional costs, it offers peace of mind and superior security.

Finally, whatever method you choose, maintain detailed records of your purchases and storage locations. This documentation can simplify future transactions and assist in tracking the performance of your investment.

5. Keep an Eye on Premiums

Understanding premiums is crucial when buying silver bullion. A premium is the amount added to the spot price of silver to cover the costs of production, distribution, and dealer margin. This premium can vary widely based on market conditions, demand, and the type of bullion being purchased.

When shopping for silver, always be aware of the current spot price and the premiums associated with different products. Compare premiums across various dealers to identify the best options. Sometimes, paying a slightly higher premium for a reputable product can be worth it in the long run.

It’s also important to recognize that premiums can fluctuate over time. During periods of high demand, such as economic uncertainty, premiums can increase significantly. Monitoring these changes can help you make more strategic buying decisions.

Don’t hesitate to negotiate with dealers, especially if you’re making a larger purchase. Some dealers may be open to reducing premiums, particularly for bulk orders. Building a good relationship with your dealer can also open doors for future discounts or exclusive deals.

By being informed and proactive about premiums, you can enhance your investment strategy and maximize the value of your silver bullion purchases.